Sigma Blog

Learn about how Sigma crushes complexity and delivers speed to our users.

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

April 26, 2024

Tracking spend down to the SKU: How OnCorps AI uses Sigma and Databricks to keep costs down

Success Stories

Success Stories

All

All

April 23, 2024

Develop a Predictive Model using Snowflake and Sigma

Machine Learning

Machine Learning

All

All

Predictive Modeling, Snowflake, Snowpark, Sigma, Data Science, ML, AI

April 10, 2024

Here’s why this golf course management platform left Tableau for good

No items found.

All

All

April 5, 2024

Astronomer Data and AI exec explains how switching to Sigma “fundamentally changed how we sold”

Success Stories

Success Stories

All

All

April 4, 2024

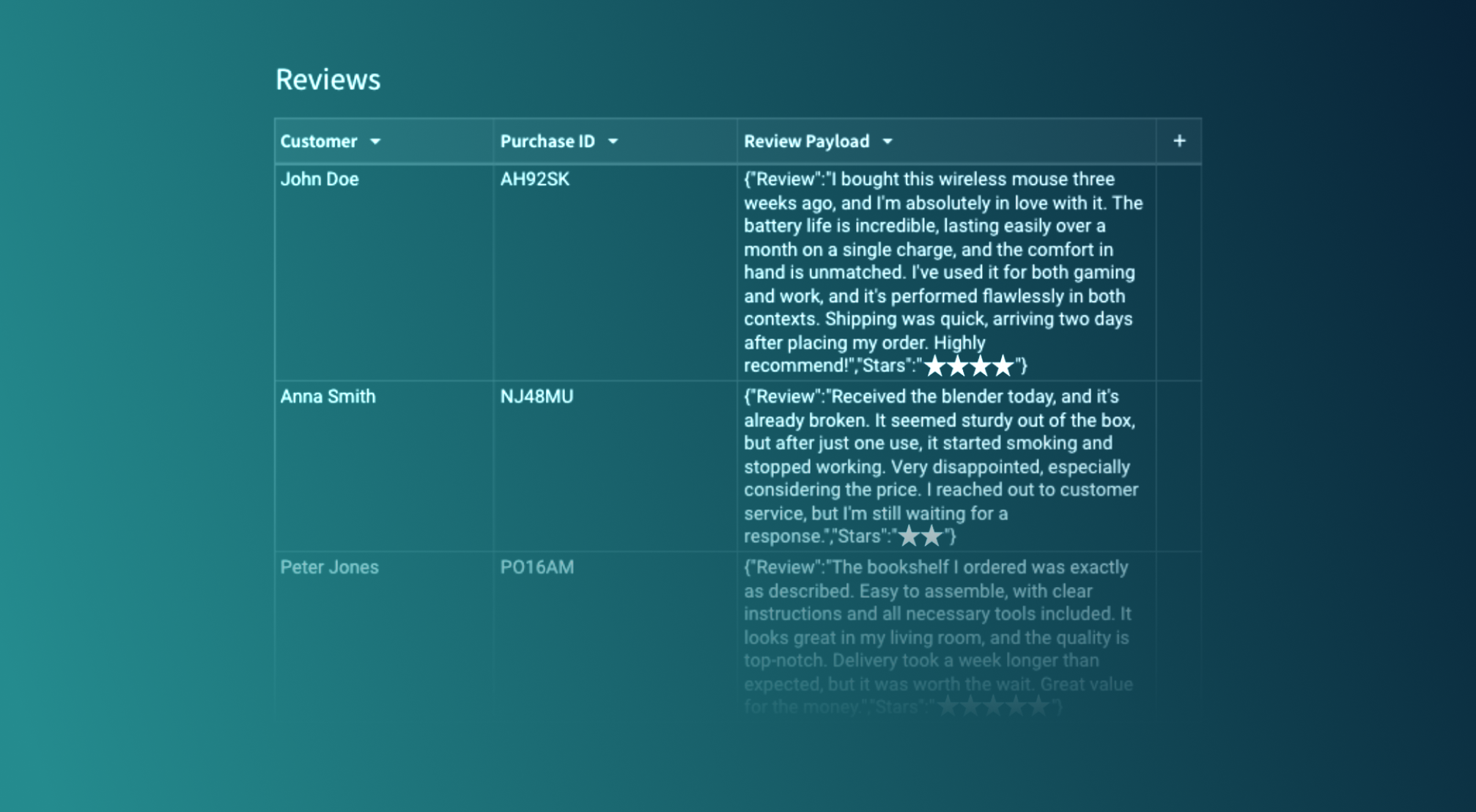

Unlocking the treasure trove: harnessing unstructured data with Sigma's text processing tools

No items found.

All

All

March 27, 2024

When does talking about a dog increase your sales win rate?

Data Analytics

Data Analytics

All

All

February 15, 2024

How to Successfully Navigate AI in BI: 7 Key Considerations

Machine Learning

Machine Learning

All

All

AI, artificial intelligence, business intelligence, BI, security, privacy, analytics, product analytics, trust, sensitive data, automation, predictive analytics